Introduction to Strategic Management

In this chapter, you will:

- Understand what is strategic management

- Understand the process of strategic management

- Learn tools that can be used for strategic management process

- Learn Strategy formulation, Strategy execution, evaluation and control

Strategic management involves defining the vision and the mission of your firm which clearly define what the firm aspires to become and the reason for its existence. Once the vision and mission are defined, an internal and external environment analysis is carried out to identify opportunities and threats emerging in your firm’s environment and your firm’s strengths and weaknesses.

The strengths of your firm are leveraged upon to build competitive advantages and core competencies and capabilities to outperform competition. Strategic management is a continuous process and not a point-in-time exercise. Periodic reviews of strategies and the incorporation of new elements in line with changes in the environment are essential in strategic management.

Strategic management is a comprehensive procedure and starts with a strategic diagnosis. It continues with a series of additional steps, culminating in new products, markets, technologies, and capabilities. The strategic task of the leadership team is to challenge the prevailing set-up with a single question: “Why?”, and to ask the same question as many times as necessary to make the future as clear as the present for managers at all levels. For example, the strategist at a leading luggage company in America would be asking questions like why should we not enter the European market in the next financial year? Or why cannot we surpass our competitor’s market share in the next two years? The answers to these questions will create avenues for growth which would not have emerged had these questions not been asked.

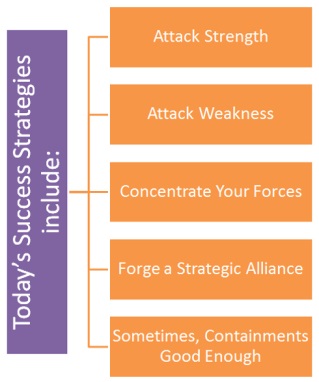

Strategic management enables your firm to survive in the long run. It maps your firm’s strengths and weaknesses against the competitor’s strengths and weaknesses and enables it to leverage on its resources to achieve its goals. It is through strategic management that the long-term vision for your firm is set which provides your firm with an indication of its growth direction. Strategic thinking involves answering three basic questions:

- Where are we now?

- Where do we want to go in the future?

- How will we get there?

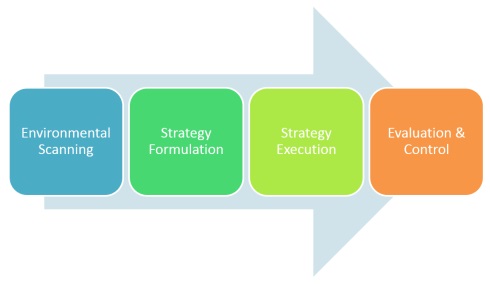

The Process of Strategic Management

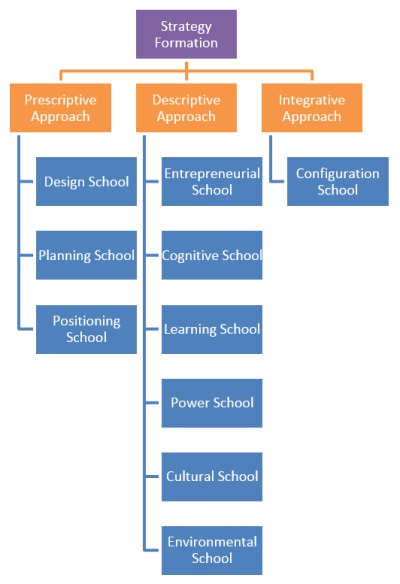

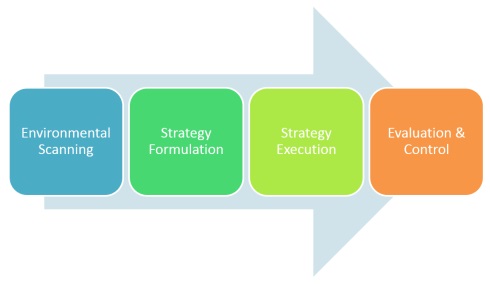

There are four basic elements in the process of strategic management:

- Environmental scanning

- Strategy formulation

- Strategy execution (implementation)

- Evaluation and control

The Process of Strategic Management

Environmental Scanning

Environmental scanning involves monitoring the environment, and evaluating and disseminating information obtained from the internal and external environments.

Following table lists out the external and internal sources of information used for environmental scanning. The aim of environmental scanning is to identify the strategic factors that may determine the future of your firm. An organization can derive several benefits from environmental scanning including the development of a common perception, identification of strengths and weaknesses an understanding of trends and conditions, and the optimum utilization of internal and external information. Techniques such as secondary research, surveys, and questionnaires focus groups, and open forums can be employed in environmental scanning.

| External Sources of Information |

Internal Sources of Information |

Personal contacts

Journals/magazines, books, newspapers

Annual reports

Professional conferences and meetings

Radio, television, and the Internet

Professional colleagues

Customers

Commercial databases

|

Personal contacts

Internal reports and conference papers

Internal memoranda

Committees / Meetings

Sales staff, other employees and managers

Internal databases

Internal audits and the Board of

Directors

|

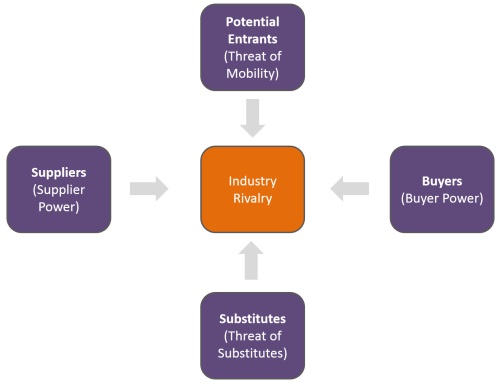

SWOT analysis is often used along with environmental scanning. SWOT is an acronym for the strengths, weaknesses, opportunities, and threats faced by your firm. Strengths and weaknesses are within the control of the top management in the long run. Opportunities and threats are external factors that are outside the control of the organization.

Following table depicts the SWOT analysis for a hypothetical tire company. In the automotive segment, the company supplies tires to major original equipment manufacturers and has an equally strong position in the replacement market.

| Strengths |

Weaknesses |

Strong market position

Diversified operations

Strong focus on Research & Development

|

Deteriorating liquidity

Lower inventory turnover ratios

Low employee productivity

|

| Opportunities |

Threats |

Expansion of global airline fleet

Opportunities in India and China

Positive outlook for specialty tires

|

Increasing raw material costs

Sluggish heavy and medium truck tire sales

Intense competition

|

A careful analysis of the SWOT here will clearly highlight the areas on which the firm needs to focus. For instance, immediate attention needs to be given to improving employee productivity and improving the inventory turnover ratio.

Case Study: Sears Reinvents Itself

In the 1980s, Sears, which was one of the largest retailers in the United States, entered other businesses such as banking, investment, and real estate services, in addition to selling appliances, hardware, clothes, and other goods. In those days, the ‘Big Book’ catalog of Sears was considered the primary (and sometimes the only) source for items ranging from wrenches to bathtubs.

When Sears diversified its activities from its main business of retail sales, the company steadily lost ground in retailing, falling from the Number 1 position to Number 3 behind Wal-Mart Stores, Inc. and Kmart Corporation. Sears could not keep up with discounters such as Wal-Mart and Kmart, and with specialty retailers such as Toys R Us, Home Depot, Inc., and Circuit City Stores, Inc. that focused on a wide selection of low-price merchandise in a single category. Neither could Sears compete with trend-setting department stores. In the 1990s, Sears came to a stage where it was neither sure of its customers nor its competitive basis. This was a lacuna in the company’s strategy.

Arthur C. Martinez, the then CEO of Sears, went in for a major strategic overhaul. Under the new strategy, the company decided to concentrate on its core businesses. It disposed of its non-retail assets, upgraded the section on women’s apparel, renovated some stores, and launched an advertising campaign to effect a turnaround at Sears. Through extensive customer research, Sears found that its hardware lines enjoyed a very high level of brand loyalty. Moreover, research suggested that customers preferred convenience to breadth of category in its hardware stores.

After its hardware store idea was successfully tested, the company drew up a plan to set up 1,000 freestanding, 20,000-square-foot hardware stores by 2006 at a cost of $1.25 million per outlet.

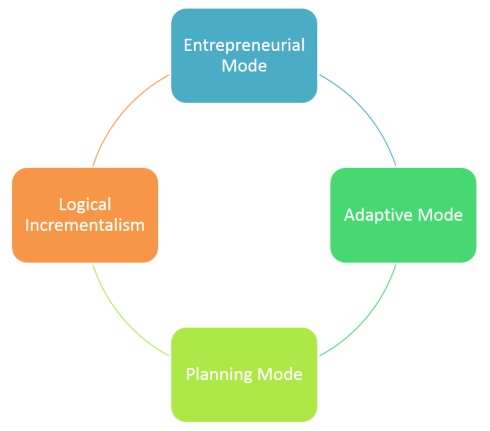

Strategy Formulation

Strategy formulation refers to the development of long-term actionable plans for managing opportunities and threats in the external environment, and for utilizing the strengths and overcoming the weaknesses within your organization. The strategy team takes into consideration components of strategic management such as mission, internal profile, external environment, strategic analysis and choice, long-term objectives, annual objectives, and grand strategy while formulating a strategy. Above case study describes environmental scanning and strategy formulation in a firm.

Strategy formulation helps an organization to:

- Capitalize on available opportunities.

- Address the challenges faced by the organization.

- Provide leadership that understands and masters change.

- Incorporate an in-depth planning model.

Strategy Execution

The process by which strategies are put into action is called strategy execution or strategy implementation. Programs, budgets, and procedures are developed for this purpose. This process may call for changes in overall culture, organizational structure, and/or the management system. Strategy execution is typically handled by middle and lower level managers, except when drastic organization-wide changes are needed. However, the progress of the implementation is reviewed by the top management from time to time.

Your firm’s structure plays a vital role in achieving its objectives. A proper structure is essential for strategy to be operational. Structure serves as a vehicle for managers to exploit the skills and capabilities of their subordinates. They can further use the structure in motivating their subordinates through providing incentives to ensure superior efficiency, quality, innovation, or customer responsiveness.

Budgets are used for planning and control. The budget details the investments to be made and the returns expected from the investments. The budget is also a proforma financial statement.

Case Study: Strategic Objective of Ford Motor Company

“To satisfy our customers by providing quality cars and trucks, developing new products, reducing the time it takes to bring new vehicles to market, improving the efficiency of all our plants and processes, and building on our teamwork with employees, unions, dealers, and suppliers.”

Case Study: Financial Objective of 3M Corporation

“To achieve annual growth in earnings per share of 10 percent or better, on average; a return on stockholders’ equity of 20-25 percent; a return on capital employed of 27 percent or better; and have at least 30 percent of sales come from products introduced in the past four years.”

Evaluation and Control

The ultimate test of the strategy is its ability to achieve the ends — in terms of vision, mission, and long-term objectives. The firm is successful only to the extent that the strategy used achieves the ends. Strategy formulation is largely subjective, and the first test of reality for a strategy is in its implementation. When a strategy is implemented, it should be monitored to determine the extent of success, that is, the number of objectives achieved. Strategic managers should employ timely monitoring and control methods, to ensure successful execution of the strategy. Periodic review and evaluation is also helpful for making modifications to the plan.

Evaluation and control refer to the processes in which corporate activities and performance results are compared with the desired performance. This information is used to take corrective action and resolve problems. It also pinpoints the weaknesses of strategic plans implemented earlier. Thus, this exercise provides a valuable opportunity for organizational learning.

For effective evaluation and control, your firm’s management must obtain clear, prompt, and unbiased information from the people who actually execute the strategies. Unbiased information is essential as this information is used for corrective action and to minimize the mistakes the organization might commit in the future.

Feedback is a very important part of the evaluation process as it provides an opportunity to revise or correct decisions made in the earlier stages. Poor performance indicates that something has gone wrong with either strategy formulation or implementation. It could also mean that a variable was ignored in the environmental analysis.

The feedback from execution, evaluation, and control will loop back into the early stages of planning. Feedback is defined as the post-implementation results, collected as inputs for future decision-making. Plans for the future should reflect changes brought about by previous strategic actions.

Refer to following Case Study for details of Wal-Mart’s failure in strategic management/execution in its German operations.

Case Study: Wal-Mart’s Misadventure in Germany

For the world’s largest retailing company — Wal-Mart Inc. (Wal-Mart) — the German market was proving to be a tough nut to crack. By 2003, even five years after entering Germany, Wal-Mart was continuing to make losses. Though Wal-Mart did not reveal these figures, analysts estimated its losses at around US$ 200-300 million per annum in Germany, over the five-year period.

According to analysts, the main reason for Wal-Mart’s losses was its failure to understand the German culture and the shopping habits of the Germans. Though Wal-Mart was famous the world over for its Every Day Low Pricing (EDLP), which had turned it into the world’s number 1 retailer, it failed to make an impact on Europe’s most price-sensitive market — Germany. Wal-Mart also ran into a series of problems with German regulatory authorities for its pricing strategies and faced considerable opposition from German suppliers to its centralized distribution system. It had problems with its German workers too.

Wal-Mart expanded its presence into Germany through acquisitions. It acquired the 21-hypermarket stores of Wertkauf in 1997. The Wertkauf stores offered both food and general merchandise to customers. Wal-Mart sources said that Wertkauf stores would provide it with the necessary foothold in the German market. However, as Wertkauf covered only southwestern Germany, it failed to provide the required market penetration to Wal-Mart in Germany. In 1998, Wal-Mart acquired Interspar’s 74 hypermarket stores to raise the total number of Wal-Mart stores in Germany to 95.

With the acquisition of Interspar’s stores, Wal-Mart became the fourth largest hypermarket retailer in Germany. However, neither the Wertkauf nor the Interspar stores were popular with German consumers. A major challenge for Wal-Mart was to change customer perceptions about the stores. Wal-Mart was criticized for acquiring Interspar’s stores as they had made heavy losses and had a poor brand image in the public mind. However, while acquisitions may not have been the ideal route for Wal-Mart to take in Germany, the company, in fact, had little choice. The German government was refusing new licenses for food and grocery retailing, so if it wanted to enter the German market, Wal-Mart had to go in for acquisitions. Soon after acquiring the stores, Wal-Mart hurried through with their renovation and put its brand name on them to make sure its EDLP message went across. But it was unable to cash in on its EDLP selling point, chiefly because of the strong competition from German retailers. Whenever Wal-Mart lowered its prices on commodities, German retailers such as Aldi, Lidl, Rewe, and Edeka too lowered their prices to retain their customers. Wal-Mart therefore found it difficult to get a foothold.

The lack of strong vendor relations also affected Wal-Mart’s operations in Germany. Unlike in the US, where the company and its suppliers were accustomed to centralized distribution, in Germany, suppliers were not comfortable with the system that Wal-Mart adopted.

Another operational problem that Wal-Mart faced was employee unrest. It was accused of paying low wages and of not providing good working conditions. Wal-Mart did not understand the German work culture. It ran into trouble with the

German unions when it announced employee lay-offs and store closures in 2002 in order to reduce its personnel costs. In addition, it also refused to accept the centralized wage-bargaining process in the German retail industry. Because of this, the trade unions organized a walk-out from Wal-Mart stores, which led to bad publicity for the company.

Summary:

- Strategic management involves defining the vision and the mission of a firm which clearly define what the firm aspires to become and the reason for its existence.

- Strategic management is a comprehensive procedure and starts with a strategic diagnosis.

- Strategic management enables your firm to survive in the long run.

- Basic elements of strategic management are:

- Environmental scanning

- Strategy formulation

- Strategy execution (implementation)

- Evaluation and control

MBA INSTITUTE™

MBA INSTITUTE™